Student Loan Debt Crisis

The Problem

According to original research by One Wisconsin Institute, the student loan debt crisis has been shown to be a huge drag not just on borrowers' household budgets, but the entire state economy, reducing new car purchasing by over $200 million annually and leaving middle class households with student loan debt more likely to rent than own a home.

"Two-thirds of Americans now leave college weighed down by massive student loan debt, unable to achieve their dreams and contribute to the growth of the economy. Congress should be doing all that it can to make a college education as affordable and accessible as possible." - Rep. Mark Pocan

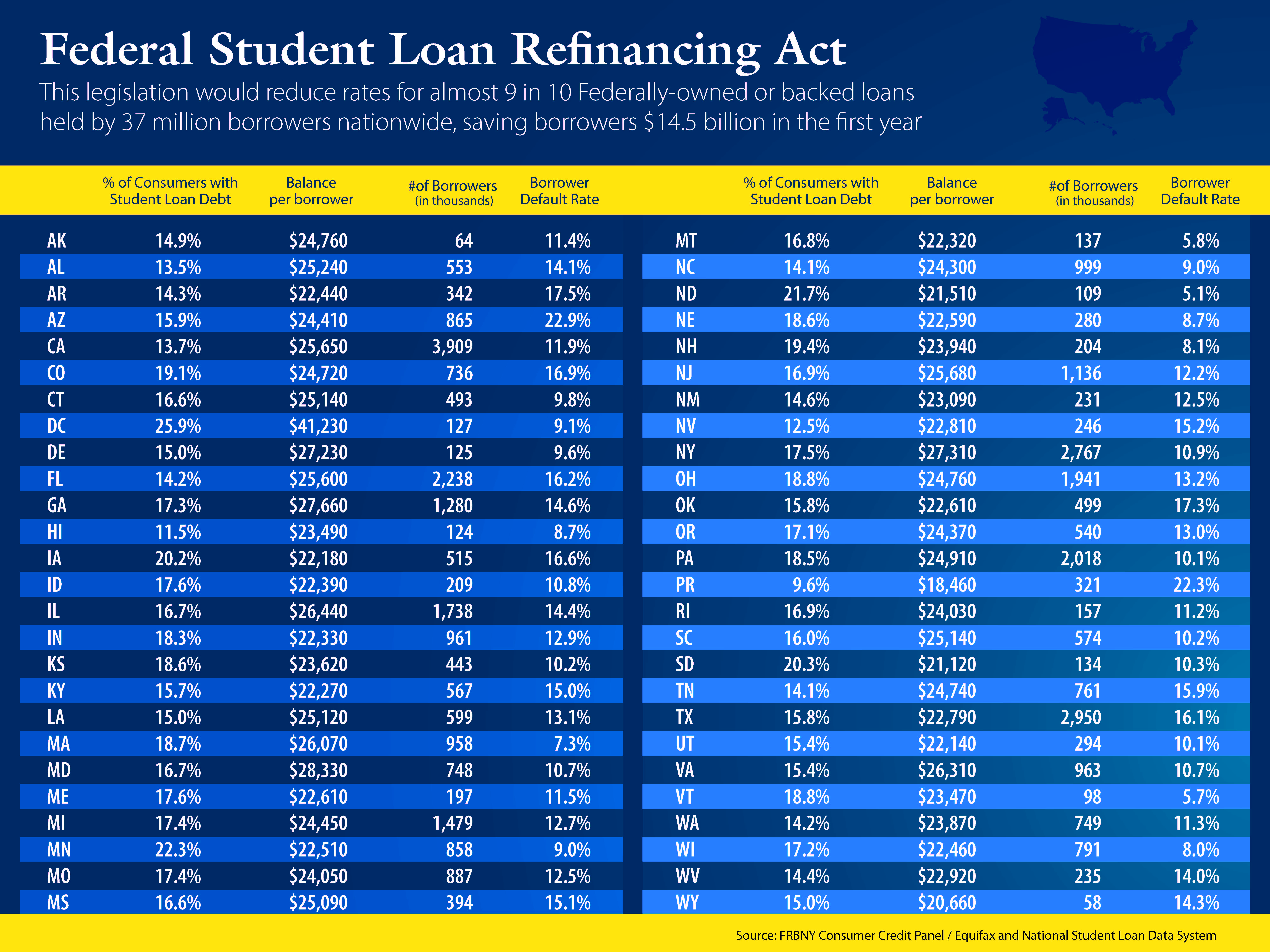

In Wisconsin, the average student graduates from college owing $22,460 in student loans. Nearly 800,000 individuals in Wisconsin currently have outstanding student loans. By allowing the average borrower to refinance their loans at 4%, they would be saving $8,483 over the 20 year life of the loan.

Student debt has exploded in the last decade:

During 2013, consumer credit outstanding increased about 6 percent to $3 trillions. Auto loans and student loans accounted for almost all of this increase. Costs of education rose, and federal programs remained the dominant source of education lending, continuing to expand at a rapid pace in 2013.

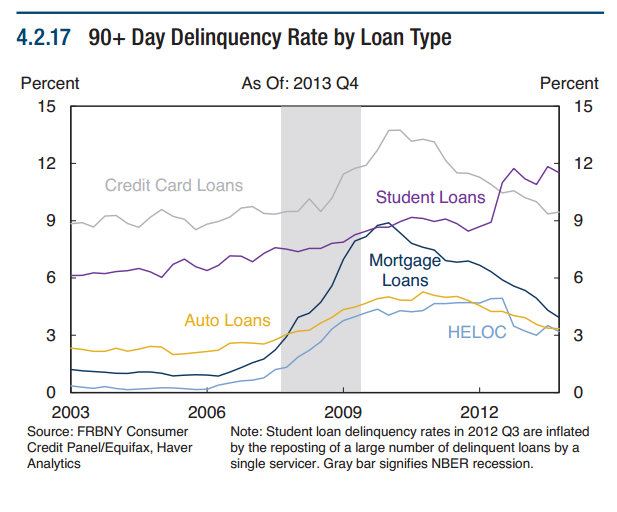

Student loan delinquency rates are outpacing other forms of debt:

While households are becoming more current on most types of debt, the delinquency rate on student loans outstanding rose to 12 percent at the end of 2013. Large and growing student debt burdens and continued weakness in labor markets have pushed many younger borrowers into delinquency, despite the longer grace periods that typically accompany student loans.

How do we fix the student loan debt crisis?

On May 9th, U.S. Rep. Mark Pocan (WI-02) & U.S. Rep. Scott Peters (CA-52), along with 21 House Democrats, introduced H.R. 4622: Federal Student Loan Refinancing Act. The Federal Student Loan Refinancing Act would call on the Secretary of Education to automatically lower all federal student loans to 4 percent – which is near the current 30-year mortgage rate. Refinancing allows the borrower to replace his or her existing debt with a new loan at a lower interest rate. This means that borrowers will reduce the cost of their debt and free up income for purchases that will create a ripple effect on the economy. The bill introduced today is the House companion to S. 1066 which was introduced by New York Senator Kirsten Gillibrand in the U.S. Senate.

In the fall of 2013, Congressman Pocan introduced a bill that would allow borrowers to refinance their loans whenever lower rates become available. Rep. Pocan is also an original cosponsor of the Bank on Students Emergency Refinancing Act which was introduced in the House by Representatives Tierney and Miller and in the Senate by Elizabeth Warren. This legislation further underscores the importance of allowing borrowers to refinance their loans by including refinancing options for both public and private loans.

INFORMATION & HELP FOR NAVIGATING STUDENT FINANCIAL AID CAN BE FOUND HERE.